Welcome to the second letter of Undirected Cyclic Thoughts. As I stated before, the goal is to bang out one letter each week and on the second week… I’m already a day late. But, here we are. I’m focusing down to one theme I’m exploring this week which is medical debt. Still no guarantees this will be worth your time.

“Healthcare is a right and I shouldn’t have to pay my bill”

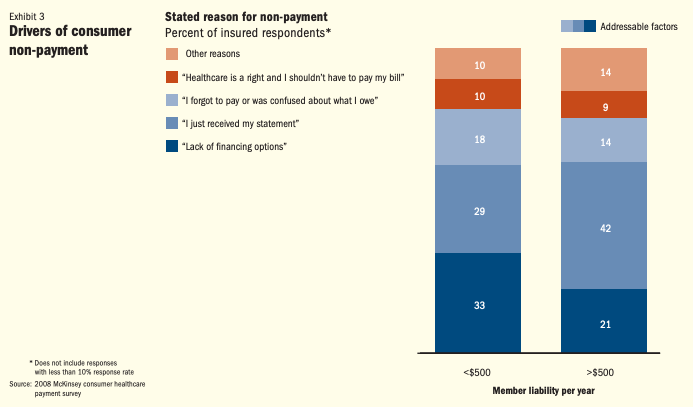

That, my friends, is the 4th most stated reason for why insured patients didn’t pay their bill, according to a McKinsey report on healthcare payments.

Regardless of your political beliefs, you do not currently have a right to non-payment in the U.S. Moreover, non-payment — irrespective of the underlying reason — is driving the amount of medical debt in the U.S. to an all-time high. That amount was most recently reported at over $81B.

There are two ways to look at this problem: (1) why aren’t people paying off their medical bills?, (2) why are the costs so high in the first place? Let’s tackle these in reverse.

Why are costs so high in the first place?

There’s been a lot of rhetoric around this second question. Especially as the democratic primaries heat up. But, I think that the question is important nonetheless.

The rhetoric you’ll find on the internet — over-utilization of the system, too many specialists but not enough primary care docs, fee-for-service medicine — isn’t quite accurate.

A review performed by Ashish Jha, recently published in the JAMA, contradicted this narrative. His research team found that we’re actually in the middle of the pack when it comes to the percentage of doctors practicing primary care and the average number of hospitalizations and doctors’ visits.

Instead, they found that costs are high because of a complex three party system (provider, payor and patient) leading to disproportionate administrative costs as well as rising overall prices for hospitalization and prescription drugs.

I would posit that yet another cause of the high medical spend is non-payment itself. There’s a nice (or rather, not-so-nice) positive feedback loop at play here.

There are definitely interesting ways to approach our complex payment system, whether it’s requiring more transparency with insurance companies or the more extreme Sanders approach of burning the place to the ground. But, this is only one angle from which to approach medical debt. The second asks why it’s not paid off.

Why aren’t people paying off their medical bills?

This question seems to get slightly less attention and, in the era of “everything becomes a bank,” seems closer to a problem that can be solved by private enterprise — even if only partially.

Before diving into the causes of non-payment, here are some interesting facts to put this problem in perspective:

137.1M Americans reported medical financial hardship in the past year, according to a recent study in the Journal of General Internal Medicine

The credit scores of 43M Americans are being affected by overdue medical debt, according to The Atlantic.

21% of adults have not undergone a recommended treatment plan because of cost, while 32% of adults have postponed medical care they needed for that reason, according to the Kaiser Family Foundation.

26% of adults say that they or their household member had problems paying medical bills in the last year. Even more striking, 34% of insured adults said it was “very difficult” or “somewhat difficult” to meet their deductible, according to the same KFF report.

It may be easy to look at these statistics, look at the high healthcare costs being driven by administrative overhead and expensive hospital visits, and ¯\_(ツ)_/¯.

If the costs are too high, why even worry about repayment?

What’s interesting is that when you peak behind the curtain, most overdue medical debt isn’t as complicated as a guaranteed bankruptcy. It’s a lot simpler than that.

Going back to the McKinsey study that looked at insured respondents, the most common reasons for non-payment are shockingly unnecessary:

For liabilities less than $500, 33% of patients did not pay because they lacked financing options (solvable), 29% did not pay because they just received their statement (i.e. initial statement lost — solvable), and 18% did not pay because they forgot or were confused (wtf ?! — solvable).

So to recap, 80% of cases of non-payment are caused by completely addressable factors. These aren’t even factors that require fancy “blue ocean” innovation to solve. They can pretty much be boiled down to two edicts:

Offer better financing options

Improvement payment collection services

I hope to explore both in a future post. But that’s all I have time to write for now.

Notable Content

Favorite podcast of the week —

Andy Rachleff on “How to Know If You’ve Got Product Market Fit” - Starting Greatness

Worth a read —

Valley Forged: How One Man Made the Indie Video Game Sensation Stardew Valley - A Randian hero.

Apple: The Coronavirus Impact - Globalization in a nutshell.

How to Write Usefully - Useful article on how to write usefully.